How To Set Targets In Intraday Trading

Intraday trading requires measured actions, the capacity to monitor the market place like an eagle, and the capacity to make challenging buy and sell decisions at the proper fourth dimension.

If you are new to the stock market and want to know how to do Intraday Trading, here are all things which help yous to empathize how Intraday trading works.

How To Practise Intraday Trading?

In Intraday trading, the trader is expected to square off the position the same day before the stock market closes, regardless of turn a profit or loss. Hither are the Important points to keep in mind while doing Intraday Trading:

- A smart advice is to trade with the current market tendency. If the market is declining, sell commencement and buy later, and vice versa.

- Make an intraday trading plan and stick to it.

- Prepare your desired profit and stop-loss limit.

- Don't go too far ahead of yourself and book your gains at regular periods.

- Go along stop-loss levels. It allows you to limit your losses if the market does non perform well.

- If you are not a seasoned trader, pick highly liquid stocks and merchandise in a modest number of stocks at a fourth dimension.

Understanding Intraday Trading for beginners

Let'southward discuss almost the to a higher place points in details how to do Intraday Trading to make an beginner sympathise more about the Intraday Trading:

-

Entry & Exit Points

Trading with a widespread intraday tendency is a fantastic idea. This provides the opportunity for depression-risk entry positions with a great potential for profit if the trend continues.

Identifying such trends aids in the evolution of useful entry and finish-loss tactics. To make up one's mind when to quit, consider 2 weather condition:

when yous take met your target profit or when yous have accomplished the maximum loss limit that you do non want to go below. When you have reached the desired turn a profit effigy, yous can consider leaving.

-

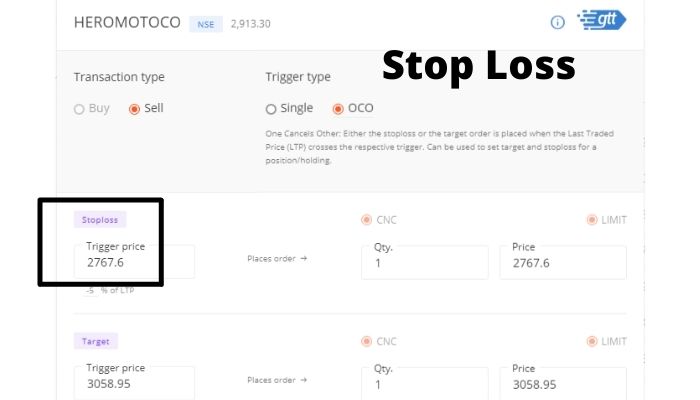

Stop Loss

Frequently have a terminate loss every bit an outgrowth of the commencement point. A stop loss is a course of go out strategy that you can use if your tendency or apprehension does not pan out.

If, on the other hand, your prediction comes true, you lot should know how to set respective target levels – T1, T2, etc. – and then that you lot tin can exit at unlike price points.

-

Previous charts

Nosotros are all enlightened that history repeats itself. While this cannot be guaranteed, historically, stocks tend to follow their historical path.

As a result, the goal should exist to discover a proper noun that maintains capital while even so providing returns at a controllable risk.

Afterwards evaluating the trend and comprehending its qualities, you may make up one's mind to begin trading a few names at first.

Remember to select a liquid proper noun with a high average daily volume. This assures that yous can detect buyers while exiting.

-

Go along Emotions aside

Traders are ofttimes disheartened when their skill to pick names fails to provide results. Beginners should utilize historical assay to identify chances and develop trading techniques based on those names.

In improver, an individual should have well-divers profit and loss levels and should not allow his or her emotional trend to take command of the trading activity.

If yous've created an entry and exit strategy that all-time suits your needs, don't alter it carelessly in the middle of a merchandise. Trading properly demands that you remain vigilant and in accuse at all times.

-

Start Minor

A few successful transactions may have strengthened your conviction, only information technology is even so likewise presently. In the beginning, don't be too ambitious with your bets. To begin, limit yourself to no more than 1-2 stocks.

The volume and value should be increased over time. Starting smaller will enable you to make mistakes and gain experience with how the market operates, allowing you to avert making the aforementioned mistakes twice.

Increase your trading volume steadily as your cognition and risk tolerance abound.

-

Avoid Penny shares

Penny stocks offer uncommonly large returns only as well take a high level of volatility. Due to the obvious high danger of financial loss, you should avert penny stocks equally a novice.

You may enter the category one time you are satisfied with the strategy and take a good understanding of the trends.

-

Go along Calm

While intraday trading forces yous to be hyper-vigilant nearly the market place, information technology undoubtedly causes anxiety. Therefore don't let it get the all-time of you.

Logic and rationale should be used to make trades and judgments. Fearfulness, greed, attachment, and other negative emotions should exist avoided.

Difference between Regular Trading and Intrday Trading

Taking delivery of shares is one of the key differences between intraday and regular trading. In intraday trading, the trader is expected to close the position the same mean solar day, regardless of turn a profit or loss, before the market closes.

In normal trading, the trader may opt to remain invested for a period of time, and thus, depending on the type of the stock, a trade settlement is made in a few days.

Furthermore, in that location is no change in stock buying in intraday trading, although in delivery, share ownership transfers and rights are transferred from the seller to the heir-apparent.

Later on settlement, the stocks are held in the demat business relationship.

Other Trading Strategies

After understanding how to do intraday trading? Let's check out what are your culling options if y'all want to don't want to have risk with you funds? Here are several alternatives to intraday trading:

-

Swing Trading

Swing trading is a trading method in which traders acquire a stock or other nugget and go on it – known every bit holding a position – for a brusk length of time (typically a few days to several weeks) in the aim of profiting.

The swing trader's purpose is to profit from any potential price volatility or "swing" in the market. Private wins may be less because the trader focuses on brusque-term trends and strives to eliminate losses every bit apace as possible.

Small profits obtained regularly over time, on the other hand, can add up to an appealing annual return.

-

Long Term Investing

A long-term investment represents the company's assets, such as shares, bonds, existent estate, and cash. Long-term investments are assets that a investor plans to go on for more than a year.

The long-term investment business relationship differs significantly from the short-term investment account in that brusk-term investments will nearly certainly be sold, whereas long-term investments volition non be sold for years, and in some cases will never be sold.

Being a long-term investor implies that you are willing to tolerate some take a chance in exchange for potentially greater benefits and that you can beget to exist patient for a longer length of fourth dimension.

-

Algorithmic Trading

Algorithmic trading is a method of executing orders that employs automated and pre-programmed trading instructions to account for factors including price, timing, and volume.

A set of instructions for solving a problem is referred to equally an algorithm. Over time, calculator algorithms send little chunks of the unabridged order to the marketplace.

Algorithmic trading makes choices to buy or sell financial securities on an commutation using complicated calculations, mathematical models, and human oversight.

Traders frequently employ high-frequency trading equipment, which allows a firm to execute tens of thousands of trades per second. Order execution, arbitrage, and trend trading can all benefit from algorithmic trading.

Conclusion

Intra-24-hour interval trading is complex, and this tutorial should only be used every bit a starting stride to dive deeper into this trading style. It is also worth noting that this sort of trading is not appropriate for all share market traders or investors.

This is all from our side regarding How To Do Intraday Trading? Allow us know your views in the comment section.

Other Interesting blogs related to How To Do Intraday Trading:

Intraday Trading Tips

Is Intraday Trading Safety?

Best Indicator for Intraday Trading

Often Asked Questions

How can I do intraday trading?

In intraday trading, the trader is expected to close the position the same day, regardless of profit or loss, earlier the market closes. In normal trading, the trader may opt to remain invested for a menstruum of fourth dimension, and thus, relying on the type of the stock, a trade settlement is made in a few days.

How does intraday trading Piece of work case?

A trader holds a share with a current marketplace value of Rs 200. The trader then enters a stop guild instructing the stockbroker to sell the stock for Rs 195. If the price falls to Rs 195 or lower, the stop order is executed as a market order to sell the shares. while if stock hits 210 which is target set by trader he/she will exit the stock with profit.

What is intraday limit?

There is no limit for intraday trading. However, Mostly people don't merchandise more than ii-3 stock in intraday.

What is an intraday chart?

This blazon of chart displays an investment's price changes and trading volume over the form of a single trading day, which normally runs from 9:30 a.m. to 3:thirty p.thousand. Indian Standard Time. Intraday charts often cater to traders searching for short-term price patterns due to their tight time span and high caste of information.

Is day trading and intraday same?

Day trading, as distinct to intraday trading, is the discipline of opening a position in a specific market only to go out at the closing bong. A day trader, on the other paw, discovers a premium opportunity early on in the trading day and and so pursues it session by session.

Source: https://profitmust.com/how-to-do-intraday-trading-2/

0 Response to "How To Set Targets In Intraday Trading"

Post a Comment